What is a B Corp? How does it connect with Family Offices and Philanthropy?

June 20, 2023 | Blog

What is a B Corp?

B Corp is becoming a more common term. But, what does it mean to be a B Corp? And how are B Corps, family offices and philanthropy connected?

A B Corp, or Benefit Corporation, is a structure for businesses committed to both social and environmental goals alongside generating profits. B Corps are driven by a “triple bottom line” approach, which means they consider financial performance alongside impact on people and the planet.

“Businesses that meet the highest standards of verified social and environmental performance, public transparency, and legal accountability to balance profit and purpose.

B Corps are accelerating a global culture shift to redefine success in business, building a more inclusive and sustainable economy.”

To become a certified B Corp, a business must undergo a rigorous assessment by the non-profit organization B Lab. The assessment evaluates a company’s performance in various areas: governance, workers, community, environment, and customers. The assessment also examines the company’s impact on stakeholders and determines its alignment with the B Corp values and standards. If the company meets the requirements, it can receive B Corp certification.

The certification standards are based on three main areas:

- Benefit Impact Assessment (community, customers, environment, governance, workers)

- Risk Standards (potential industry-related risks)

- Multinational Company Standards & Baseline Requirements (if applicable based on size)

History of B Corps

The organization, B Lab, was founded in 2006 in the United States. Three individuals, Jay Coen Gilbert, Bart Houlahan, and Andrew Kassoy, envisioned a certification that would hold companies accountable for the benefits of all stakeholders, not just shareholders.

The first 82 B Corps were certified in 2007. The B Lab Standards Advisory Council and a Board of Directors, as well as external stakeholder input, continuously review and update the assessment tool and certification standards.

B Corp’s Movement Today

Today, there are over 2600 B Corp’s across 60 countries. The Global B Corp Directory, provided by B Lab, allows you to search on filters, including size, location, and industry. It also allows you to search by the five pillars a company’s benefit performance is assessed on.

In 2020 B Lab launched a survey to solicit feedback from stakeholders on B Corp certification standards. Noting significant global changes since inception, B Lab wanted to assess whether certification was adequate and still meeting the original impact goals. Issues such as the COVID-19 pandemic, social inequality and climate change were addressed and assessed.

The results were announced in 2021, and the Standards Advisory Council was expanded and tasked with the certification review. Over 1,000 experts and stakeholders worldwide participated, providing feedback on evolving social and environmental factors affecting business today.

In February 2023, the proposed new requirements were announced, as well as the process and timelines for feedback and implementation. Subsequently, The new performance requirements will be based on the following eleven factors:

- Purpose

- Ethics and Anti-Corruption

- Impact Management

- Living Wages

- Worker Empowerment

- Human Rights

- Justice, Equity, Diversity, and Inclusion

- Climate

- Environmental Management

- Collective Action

- Risk Standards

B Lab feels this process will continue to ensure that the certification continues to reflect the strength of the B Corp movement while adapting and changing to the needs of its members and the issues that affect them. By adapting, B Lab will ensure that certification is truly reflectively of the businesses that differentiate and operate as a force for good.

B Corp in Canada

There are 297 B Corp companies in Canada. Notable examples of Canadian B Corp companies include:

- Bullfrog Power

- Beau’s Brewing Co.

- SPUD.ca

- Aisle, formerly Lunapads

- Danone Canada

- BDC (Business Development Bank of Canada)

- Tentree

- ecobee

Within Canada, businesses seeking B Corp certification must also meet specific legal requirements according to the legislation of the province in which they are registered and the Canadian Business Corporations Act. This may involve incorporating as a Benefit Corporation or another legally recognized entity, depending on jurisdiction.

British Columbia became the first province to adopt legislation recognizing Benefits Corporations as a legal entity for social enterprise in 2020. The BC Centre for Social Enterprise notes the definition of a Benefit Corporation to be:

“a for-profit company that commits to conducting its business in a responsible and sustainable way and it must also promote one or more public benefits”

A company can be a B Corp without being a Benefits Corporation, but a company can not be considered a Benefits Corporation unless they are B Corp certified.

B Corps in Family Businesses

With the size and power of the family business sector, one can imagine the value that B Corp status has in moving the bar on environmental, social, and governance (“ESG”) issues in North America and worldwide.

FEF research indicates that over the next 8-10 years, 60% of Canada’s family businesses will transition to new leadership either within the family (47%) or outside the family (53%). 70% of Canadian family-owned businesses report having an environmental, social and governance (ESG) strategy. Within this group, 66% attribute these ESG goals to the next generation.

Accordingly, Family Enterprise Canada and the Family Business Network (“FBN”) established the FBN Sustainable Development Goals (“SDG”). These five pillars are guide rails that support the operations, management and succession of these family businesses:

- Intergenerational Equity

- Economic Development

- Environmental Stewardship

- Social Inclusion

- Good Governance

These five pillars encompass the 17 United Nations Sustainable Development Goals

The Opportunity

Family businesses account for nearly 7 million jobs in Canada, representing over 35% of Canada’s real GDP, according to the Family Enterprise Foundation (“FEF”). In addition, family businesses, on average, outperformed other firms on financial statistics, longevity, industry and regional metrics:

“Between 2007 and 2013, total revenues grew 14.6 percent on average among family enterprises, compared to 13.9 percent for all other firms.”

With trillions of dollars at play, the opportunity to tap into new markets in the Finance, Clean Tech, and Social Purpose business markets is never greater. Family enterprises pursuing the B Corp path are setting up their Rising Generation to secure additional, or less dilutive, investment capital (preferred lending rates from banks like BDC, investor incentives and start-up/entrepreneur grants).

Additionally, businesses operating in or doing business within Europe, will need to report on their ESG impacts starting in 2025. The mandate for supply-chain transparency is even greater, if nothing else, due to regulatory changes in one of the world’s largest markets.

One ways family businesses can prepare for future ESG compliance reporting is by taking the B Corp Assessment. From this assessment, the business owners/operators/managers can design their first steps towards securing BCorp or engaging in other ESG strategies.

B Corps and Philanthropy

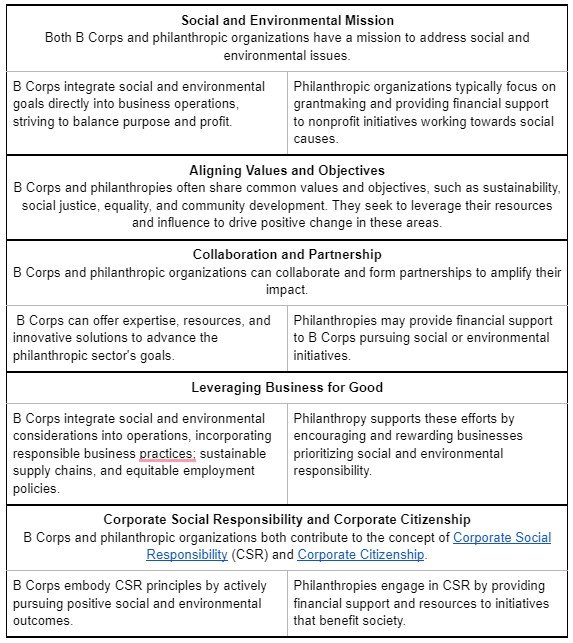

B Corps and philanthropy are linked through their commitment to creating a positive social and environmental impact. While they are distinct concepts, both aim to address societal challenges and contribute to the greater good. While B Corps focus on integrating purpose into their core business activities, philanthropy allocates human and financial resources.

Here are a few ways B Corps and philanthropy intersect:

There are several popular examples of how B Corp and Philanthropy intersect. A current example is the Patagonia story.

Conclusion

The B Corp movement redefines success in business; social and environmental goals will become a standard key stakeholder metric alongside profitability. As family businesses transition to the next generation, ESG purposes will become an essential part of the future strategy. Whether a family business is certified or not, the goals of the next generation align with the B Corp purpose.

While philanthropy focuses on traditional funding models for social change, family businesses can incorporate social change into their profitability model. Philanthropy, works towards solving social issues, but requires a source of funding for the transition of resources to a cause. Social funding, like any other resource, can ebb and flow in availability.

Perhaps as more organizations, specifically family offices, transition to a model that prioritizes social and environmental goals alongside profit, there will be less and less distinction between B Corps and philanthropy. With the next generation in Canada already driving ESG strategy in 70% of family offices, regardless of certification or status, the impact on social issues will be inspiring.

For more information on these changes, please sign up for our newsletter, as we will share details as they are provided.