Mission related investing and program related investing? What is the difference?

March 28, 2023 | Blog

The Canada Revenue Agency (“CRA”) requires private foundations to grant an annual minimum of 5% of the value of its assets (increased from 3.5% in January 2023). In 2020, Private Foundations in Canada held just over $81 billion in assets, according to the Philanthropic Foundations Canada. In the same year, those same foundations issued $3.2 billion in grants, or approximately 4%, leaving $78 billion in held assets. According to the CRA, assets can include “among others, amounts receivable, bank accounts, capital assets, cash, inventories, long-term investments, and short-term investments”. Foundation investing can be independant of the foundations goals, but can also be mission or program related.

As a private foundation there are many options when it comes to managing the balance of your portfolio and investments. Many foundations have an investment strategy that manages risk by investing in profitable businesses to sustain operations and grow. However, more foundations are seeking to align their investment strategy with their foundation’s charitable mission. Consequently, this ensures that investment gains do not come from an investment that counters or damages the good accomplished by the distributions. Over the past ten years, more foundations are adopting a strategy of impact investing. Kiplinger.com defines impact investments as:

“Impact investments are defined as investments made into companies, organizations, and funds with the intention to generate social or environmental impact alongside a financial return.”

Source: Kiplinger.com An Impact Investing Guide for Private Foundations

Mission Related Investing (MRI) and Program Related Investing (PRI) are two different approaches to investing for social or environmental purpose. While both approaches share some similarities, there are some significant differences between the two.

Mission Related Investing

Mission Related Investing (MRI) is an investment strategy that aims to achieve financial returns while supporting a specific social or environmental mission. MRI investments are made by foundations or other institutional investors who seek to align their investment portfolios with their organizational mission. The investments may be in companies or funds that have a direct connection to the mission of the foundation. Alternatively, they may be in companies not directly connected to the mission but committed to social or environmental responsibility.

Four examples of Mission Related Investments in Canada are:

- The McConnell Foundation has made several MRI’s, including Cycle Capital, a venture capital firm that invests in clean technology companies.

- The Hamilton Community Foundation, a community foundation, made a MRI in BerQ RNG. This Oakville-based company using refining equipment to create renewable gas from organic waste.

- Amplify Capital (formerly the MaRS Catalyst Fund), a Toronto-based impact venture fund, has made several mission-related investment including Alt Tex. Al-Tex created a sustainable polyester alternative, from food waste.

- The Social Enterprise Fund, an Alberta based organization that provides patient capital social enterprises in Alberta, is working with Grengine. This Alberta based company has developed a green solution to energy poverty.

Program Related Investing

Program Related Investing (PRI) is also an investment strategy used by foundations (or other institutional investors), but with a slightly different goal. PRI investments primarily further the mission of the foundation, rather than generating financial returns. Consequently, PRI investments in organizations or projects directly support the foundation’s programmatic, rather than financial, goals. The investments take the form of loans, equity investments, or guarantees, often at below-market rates.

Four examples of Program Related Investments in Canada are:

- The Catherine Donnelly Foundation has made a PRI in the Yellowhead Institute. Yellowhead is an Indigenous-led research and education centre supporting survivors of the residential school system and its ongoing intergenerational impacts.

- The McConnell Foundation has also made a PRI in Huddle Manitoba. Huddle provides free, trauma-informed and culturally-safe health services for youth in Manitoba.

- The Ontario Trillium Foundation, a Toronto based public foundation, has made a PRI in the Rivers of Hope organization. This grassroots organization uses an arts-based approach to challenging racism, prejudice, and hate.

- The Calgary Foundation has made a PRI in Momentum. This non-profit organization provides financial literacy training, affordable housing programs, and other supports to low-income individuals and families.

MRI Versus PRI – 5 factors to Consider

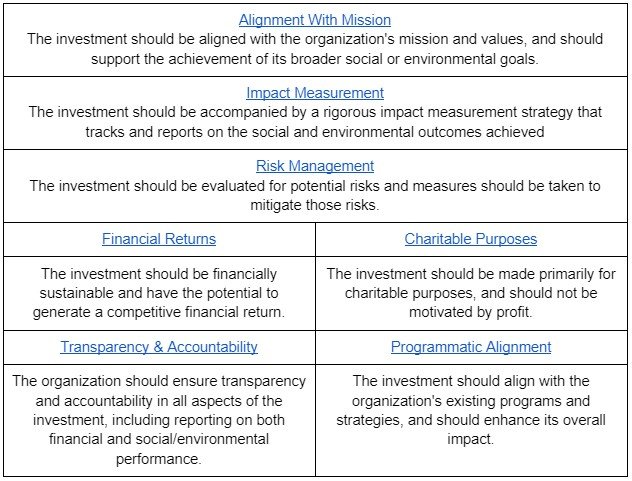

There are five key factors that individuals and institutions should consider when deciding between MRI’s and PRI’s, shown below. The first three are common to both types of investments, while the last two are specific to MRI or PRI.

Conclusion

The main difference between MRI and PRI is the primary goal of the investment. MRI investments are primarily focused on achieving financial returns while supporting the foundation’s mission, while PRI investments are primarily focused on supporting the foundation’s mission, with financial returns being a secondary consideration.

Visit us today at www.karmaandcents.com or email us here today to see how we can help your foundation meet its investing and impact goals and to learn more about mission and program related investing,