Transformational Giving – Creating a Living Legacy

April 19, 2019 | Blog

In the Spring 2019 issue of the Stanford Social Innovation Review there is a segment on making “Big Bets.” Unleashing Big Bets for Social Change focuses on how harnessing the nearly $9Trillion of worldwide private wealth can transform the face of our communities. The conundrum of Big Bet philanthropy is that the size of the gift tends to overshadow the issue that is being addressed. There is a perception that philanthropy is not held to the same level of scrutiny as traditional impact investments because there is no expectation of a financial return and a grant can be considered “lost money.”

“… big bets have played a pivotal role in propelling major social advances, from eliminating age-old infectious diseases to securing civil rights for repressed populations. Yet, looking at the gifts of all US donors to causes anywhere in the world, the vast majority of major gifts still go to universities, medical research, or cultural institutions. While these gifts strengthen important pillars of a vibrant and educated society and advance scientific frontiers, few of these institutional gifts are focused on poverty, justice, or other social change goals—causes that major donors say are the dominant motivation for their philanthropy.”

William Foster, Bridgespan, Spring 2019

Creative Destruction & Systems Change Philanthropy

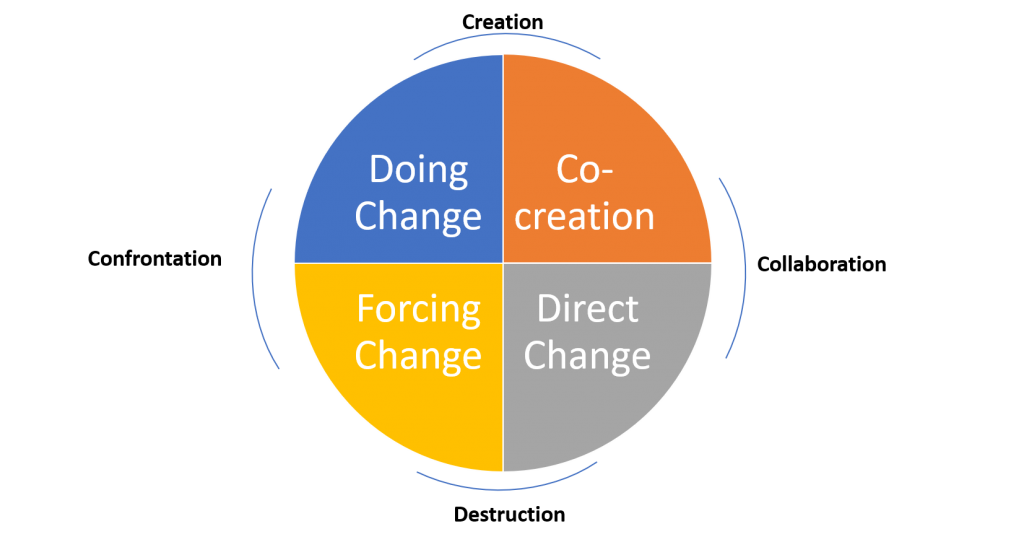

Big Bet philanthropy, just like any type of business or system disruption can be applied in one of four ways (Steve Waddell, Four Strategies for Large Systems Change):

Over the years, Karma & Cents has had the privilege of working with families and companies who want to play in the transformational change space. To date we are advising on almost $200Million in charitable assets and many of those philanthropists are looking at Big Bets in the four ways that Waddell describes:

- Creating Change – Being the seed or catalyst to jumpstart a new solution or establish a new organization.

- Co-creating change – How that investment can be leveraged and amplified by the recipient organization(s) and other funders.

- Direct Change – Getting hands on with the issue by connecting financial with other personal assets like time, talent and ties.

- Forcing Change – Capitalizing on the size of the donation in relation to the organization’s operating budget, the funder’s giving budget AND the cost associated with the problem to move the needle.

How we measure the effectiveness of these Big Bets is through the potential type of impact that will be created. When we start off with a client we help them articulate what type of impact is important to them. Impact can be measured in one of three ways:

- number of people helped,

- type of change created,

- the amount of change generated

As the adage goes, if you’ve met one philanthropist, you have met just one philanthropist. The one thing that our clients have in common is a desire to push the needle on an issue. In order to do this and be able to measure the effectiveness and impact of the funder’s philanthropy we design a Giving Portfolio. Within this portfolio is a mix of both “high risk” and stable philanthropic investments. The transformational giving can happen within the giving portfolio as a whole or into one specific organization.

Three Examples of Transformational Giving

What does a transformational gift look like? For some, like Silver Gummy Foundation it is pushing the needle on domestic violence in a specific region. For others, like Pink House Foundation, it means creating a continuum of care for those who are facing multi-generational poverty. For another foundation it is about providing a voice to those who are marginalized, like what the Catherine Donnelly Foundation has done with the Place2Give Foundation by producing a documentary on homelessness in Canada – Low Down Tracks.

Regardless if it is a systems change that you are seeking or institutional giving where you want to leave your mark, having the right partner(s) to deliver on that investment is key. When we evaluate potential partners we look at six characteristics, similar to how you would evaluate a private equity placement or seed capital in a start-up:

- Leadership – Does the partner have the right type of people with the expertise or access to the expertise to solve the problem?

- Governance – Who is backing the organization? How are they involved? What are they bringing to the table? What is the oversight?

- Community Engagement – Who else is playing in their sandbox? Do they even know they are in a sandbox? What does the competitive landscape look like? Are their opportunities for collaboration?

- Program Implementation – Does the partner have the capacity to deliver on the solution? Is there a clear pathway to deployment and scale? How does this solution fit in with other things that are going on in the sector or with other funders? Is it be measurable?

- Volunteerism/HR – Can the funder come to the table with other assets like time and talent? How stable is the organization, is staff turn-over going to affect the delivery of the solution?

- Financial Management/Fundraising – Do they have the funds in the bank to protect themselves should this solution not work? How diversified is their funding pool? It is not about the cost of raising a dollar, it is about the cost of solving the problem.

Transformative giving affects more than just the organizations at the table and the issue that are being solved. It can have lasting positive effects on the family and those associated with the funder. Transformational gifts can bring families closer together, can strengthen corporate relationships and brands, can engage employees on new levels and connect organizations that would not have made an effort to work together, to work alongside each other, not as competitors for funding dollars, but as collaborators in the solution space.

Interested in learning more about transformational giving? Give us a call 1-866-936-GIVE (4483) or drop us a line at info@KarmaAndCents.com.